Wrongful parties are often pressured into settling lawsuits sooner at much lower settlement sums than what they actually deserve. With Fund Capital America’s Los Angeles lawsuit funding and personal injury cash advance options, we keep this from happening to our clients by taking the pressure off the claims process so they have a much better chance at obtaining fair compensation.

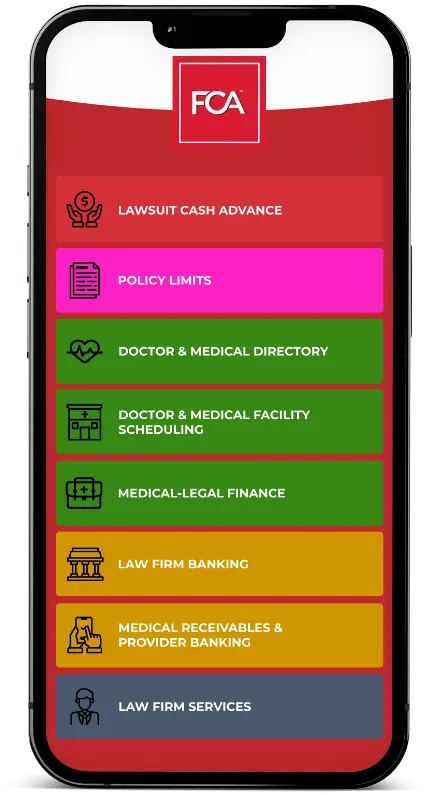

Fund Capital America is California’s leading lawsuit funding specialists. Our years of experience within the personal injury industry has led us to develop a Financial Relief Program that assists both the plaintiff and the law firm in obtaining the funds to cover the plaintiff’s everyday expenses until their case settles.

Discover Limits Within Days

Discover the policy limits that support a claim within days of taking on a client.

As a physician referral service, our job is to provide simple and convenient doctor access to attorneys. We do not get directly involved in any case. All communication takes place between the doctors and the attorneys, but we are always available to talk to either party if any discrepancies arise.

A bank or other financial institution lends money to a borrower on documented repayment terms. Bank loans may be bilateral (made by one bank to the borrower) or syndicated (arranged by one or more financial institutions and made by a group of lenders).

"*" indicates required fields

"*" indicates required fields